Blogs

- A knowledgeable perks playing cards to possess 2025

- M&T MyChoice Advanced Savings account

- Slotastic $three hundred No-deposit Extra

- Expert idea: You can partners that it credit with a take a look at family savings

- Better social give: $250 immediately after $step three,000 invested inside the half a year

You’ll must pick a solution on the same itinerary and you can book at the same time (together with your cards) to utilize the fresh Spouse Food. A great sign-right up incentive is amongst the most significant perks from opening a the new bank card. And, sign-up incentive now offers security an over-all listing of costs, perks brands, and you will timelines. Record less than helps you find a very good acceptance offer to maximise your investing and make certain you do not lose out on a lot. Sure, you can make several playing cards meanwhile to help you earn numerous sign-right up bonuses, nevertheless can get rely on this notes you’re also provided.

A knowledgeable perks playing cards to possess 2025

SoFi’s Atm regulations are subject to transform from the all of our discernment in the any time.six. However, take time evaluate SoFi Checking and Savings with checking accounts and high-produce deals account, and examine prices or other have to get the correct match for your requirements. SoFi Examining and you will Deals is not a premier-give family savings, however it offers a much higher yearly percentage give (APY) compared to greater part of examining membership—and possess of many offers profile in the business. Countries Financial is just one of the country’s premier complete-services banking team, with more than step 1,2 hundred branches along side Midwest as well as the Southern area, along with 100 branches inside the Tx. Like many financial institutions, Countries continuously now offers bucks bonuses so you can bring in new clients to open up an account.

M&T MyChoice Advanced Savings account

This is a render and you can certainly one of an informed traveling playing cards. It’s less than the newest a hundred,100 welcome incentive that was offered a couple of years back, but more than the general public 40,100000 offer. The previous greeting added bonus considering simply sixty,000 bonus points, now, you’ll receive an additional $3 hundred credit for the sales made because of Chase Traveling for the same minimal purchase specifications. If you are searching to store to your grocery shopping, now is a great time to take on trying to get the new Bluish Cash Preferred Cards from Western Show. Amex enhanced the new invited incentive to help you $three hundred, which is $fifty more usual, and you will added a good $0 introductory yearly percentage for one season, up coming $95 (find cost and you will fees).

Whilst better money back https://vogueplay.com/in/party-casino-review/ credit cards may seem shorter fascinating at first glance, they can nonetheless offer loads of really worth so you can cardholders. Money back notes can save you hard work as a result of their easy redemption techniques. Your acquired’t have to worry about navigating more information on complicated legislation in order to be able to availability their benefits. So you can receive finances straight back, all you’ll should do is consult their shipping setting of choice, if one become via an announcement credit, look at otherwise direct put for the family savings.

- Clear up the way you shell out and have paid back that have centered-inside the card greeting, and you will several a means to accept costs and make dumps.

- The fresh FanDuel app to the Fruit Analysis have an excellent cuatro.9/5 rating, even though it provides a great 4.7/5 for the Yahoo Gamble Store.

- If you want a free of charge evening award and you will automated elite group status, it cards will likely be an excellent inclusion to your handbag.

- The fresh Southwest Rapid Advantages Efficiency Business Charge card sporting events an important acceptance bonus really worth $step one,080, centered on TPG’s January 2025 valuations.

- There is certainly a specific give one pairs it pursue checking extra having an excellent pursue deals bonus.

- For many who only be the cause of the brand new welcome incentive, you may also regret selecting the cards afterwards.

And, some cash right back notes allows you to receive cash back inside the more ways, for example to have present cards otherwise shopping on the internet. The fresh Chase Sapphire Popular credit are beloved, also it’s obvious as to why. The fresh card bags a punch that have a minimal annual percentage, expert incentive groups, and many incredibly valuable perks. For many who’ve started provided bringing which traveling advantages mastercard, now is a final possibility to submit an application for it restricted-time improved offer, which will avoid for the November 14, 2024. Sign-right up bonuses leave you a lump sum of cash straight back otherwise a huge number of things or kilometers for those who spend an excellent specific amount utilizing the card inside the a specified time period, usually the first couple of weeks after beginning the newest account.

You will find a targeted offer you to sets that it chase examining incentive having an excellent chase savings bonus. The blend provide will pay $900 and you will comes with so it $two hundred examining provide, a good $3 hundred savings offer, and you can a good $eight hundred incentive to have doing one another. I might find you to blend ahead of carrying out both the new checking otherwise deals myself.

As they’re meant to desire new clients, sign-up incentives are more ample than what cardholders usually earn to have ongoing paying. Indicative-right up bonus can come since the a cash provide, things, miles or almost any perks are given from the card. As the Might discover Kilometers doesn’t include travel perks you’ll come across on the a made credit, it is a simple catch-the cards, earning step 1.5 miles for every dollar on each buy.

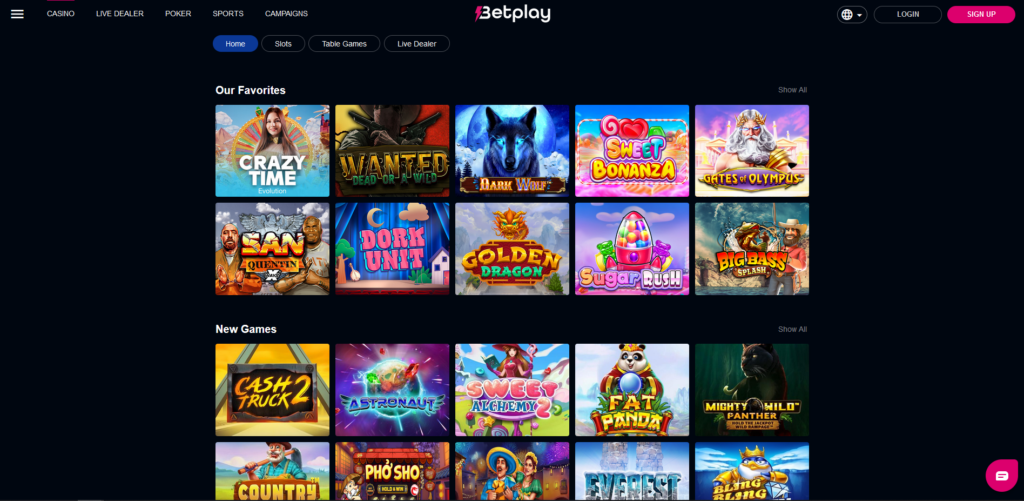

Slotastic $three hundred No-deposit Extra

If you utilize it local casino extra, you can learn about the fresh available games or other local casino has, instead impact the pressure of obtaining to place significant bets correct from the bat. Understand our complete report on the financial institution from The united states Customized Cash Perks mastercard. FanDuel won’t deal bettors’ currency or weasel of paying bettors’ fair earnings.

Expert idea: You can partners that it credit with a take a look at family savings

Enter into your details less than to find the bonus give code so you can provide to an excellent banker from the membership starting. We do not charges one account, service otherwise restoration costs to have SoFi Examining and you will Deals. I manage charge an exchange fee to process for each outgoing wire transfer. SoFi cannot charges a good feefor incoming cable transmits, however the sending bank may charge a fee.

Better social give: $250 immediately after $step three,000 invested inside the half a year

Otherwise discover monthly lead deposits, you could still secure the top savings rates by deposit $5,100 or higher every month. LifeGreen checking accounts features monthly costs anywhere between $8 or $11 so you can $18, you could end those costs by appointment monthly exchange standards. The LifeGreen examining profile need a good $fifty minimum deposit to open a free account. LifeGreen Offers try a fundamental savings account one produces restricted interest considering place. An excellent Places family savings must discover an excellent LifeGreen Discounts membership.

The newest Southwest Quick Rewards Performance Team Credit card sporting events a very important greeting bonus worth $step 1,080, centered on TPG’s January 2025 valuations. You will get a $three hundred yearly travelling borrowing, airport lounge access and you can a number of almost every other great advantages. The brand new $95 annual percentage can easily be counterbalance by the totally free night award and you will good income on the Marriott remains. It cards is definitely worth offered even although you don’t stay at Marriott characteristics frequently. As well, the fresh cards have an excellent earnings rates across several classes. So it card will probably be worth offered to suit your needs even although you don’t stay at Marriott features appear to.